What Can You Claim As Self Employed?

- 08 October 2018

- 16

Allowable Expenses When Self-Employed?

If you are self-employed you are probably wondering what expenses you can and cannot include in your Tax return to claim back a Tax rebate. Here we have a summary of allowable expenses that may help you along the way.

To ensure you receive the best possible Tax rebate it is essential to keep a record of all your earnings and expenditure. This can be done by using a cashbook or our mobile app. As a general rule, you should keep these records for a minimum of six years.

Travel Expenses

Whilst self-employed there are numerous travel expenses you can claim Tax relief on. Here are some points you will need to know:

- Expenses for journeys to and from work for temporary workplaces

- Costs for train, bus and taxi fares can be claimed, not just motoring expenses

- Parking fees and toll charges are also allowable

- Breakdown cover

- You cannot claim for non-business related driving or travel costs.

- Not can you claim for fines.

Instead of claiming the actual motoring costs, it may actually be more beneficial to claim the flat rate according to HMRC guidelines. The amount you can claim on mileage depends on your type of vehicle and travel distance, please see the table below which provides reference of cost:

| First 10,000 miles | Above 10,000 miles | |

| Cars and Vans | 45p | 25p |

| Motorcycles | 24p | 24p |

| Bikes | 20p | 20p |

For example, if you carried out 15,000 miles (300 miles per week), then you would be able to claim £7,000 as an expense on your Tax return:

10,000 miles @ 45p – £4,500

10,000 miles @ 25p – £2,500

TOTAL – £7,000

Tools And PPE

If you work within a sector that requires certain tools, uniform or protective wear to help you carry out your work you are able to claim back on those costs. You can claim back on any tools that you’ve purchased or hired plus any PPE (personal protective equipment) this includes hi- vis and boots.

There are two ways you can claim. You can either claim for exactly what you have spent with proof of receipt. If you are unsure of the costs or have no records you can claim a flat rate deduction which is a fixed amount based on your profession. It is obviously advisable that you keep back any invoices or receipts during the course of your trade.

Office, Property And Equipment

If you are self-employed you’ll have various expenses and running costs. You can claim costs on items you would normally use for less than two years as allowable expenses. Examples as follows:

Stationery

- Phone, mobile, fax and internet bills

- Printing, printer ink and cartridges

- Computer software

- Postage

Premises

- Rent

- Rates

- Light & heat

- Insurance Costs

- Other office resources

- Repairs

- Maintenance and cleaning

You can only claim for business use and purposes only. You cannot claim expenses or allowances for buying or building premises. These expenses will be of a capital nature.

Training Courses

If you have paid for any courses for yourself or an employee, you may be able to claim back the cost. This will only apply if the course is to update a current skill and not acquire a new skill set. Common courses would be CSCS for construction workers, or an SIA licence for those working in security.

For example, if your trade is that of a self-employed builder and you undertake any further training to improve your skill set then the costs for this are allowable however if you were to learn a new trade as a tiler within the building site this would not be allowable.

If the training costs are allowable, then any associated costs (e.g. travel, books or stationary) will also be allowable expenses.

Staff Expenses

You can claim back expenses on wages, salaries and other staff costs. See below for a list of allowable and disallowed expenses.

Allowable Expenses

- Wages and salaries including bonuses, commissions and any overtime paid where permanent, temporary or just casual labour.

- Employers National Insurance contributions (NIC)

- Wages costs of employing a member of your family provided that they genuinely work for the business and pay is reasonable for the amount of work they complete.

- Staff entertainment cost for example Christmas parties.

- Costs of subcontract labour.

- Employee training costs

Disallowed Expenses

- Your own drawings from the business, if you pay yourself a “salary/wages” from your business this is still classed as drawing as you cannot be an employee of your own self-employed business.

- Any excessive wages paid to family members

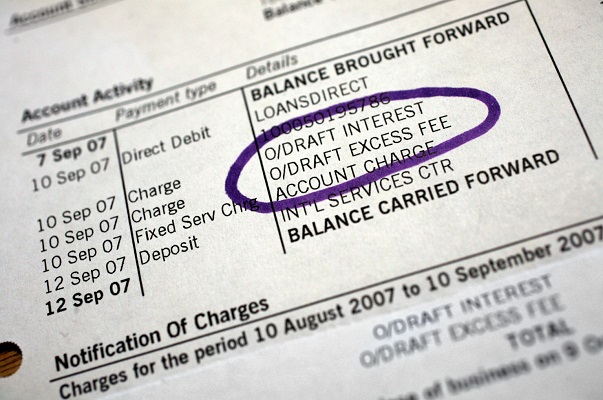

Bank Charges, Legal and Financial Costs

You can claim business costs for:

- Bank, overdraft and credit charges

- Interest on bank and business loans

- Hire purchase interest

- Leasing Payments

You can claim costs for hiring of accountants, solicitors, surveyor’s and architects for business reasons and professional indemnity insurance premiums.

You cannot claim for legal costs of purchasing property or machinery or any fines for breaking the law (speeding tickets etc).

Summary

There are many areas where Tax relief can be given for business related expenses. At QuickRebates we will ensure that you are claiming your full allowances for these expenses throughout the course of the year. As a recommendation, if there is any expenditure you are unsure about, please make a record of the cost regardless and we will use our professional judgement in deciding whether or not this should be claimed.

Should you have any further queries, please do not hesitate to contact one of our team on 0191 3553553.

- 2021-22 Tax & National Insurance Rates

- 2020-21 Tax & National Insurance Rates

- 2019-20 Tax & National Insurance Rates

- What Can You Claim As Self Employed?

- 2018-19 Tax & National Insurance Rates

- 15 Reasons Why You Could Be Due A Tax Rebate

- 2017-18 Tax & National Insurance Rates

- 17 Actionable Tips for New Business Startups

- Tax Relief for Opening Year Losses

Comments (16)

Leave Comment